how much does the uk raise in taxes

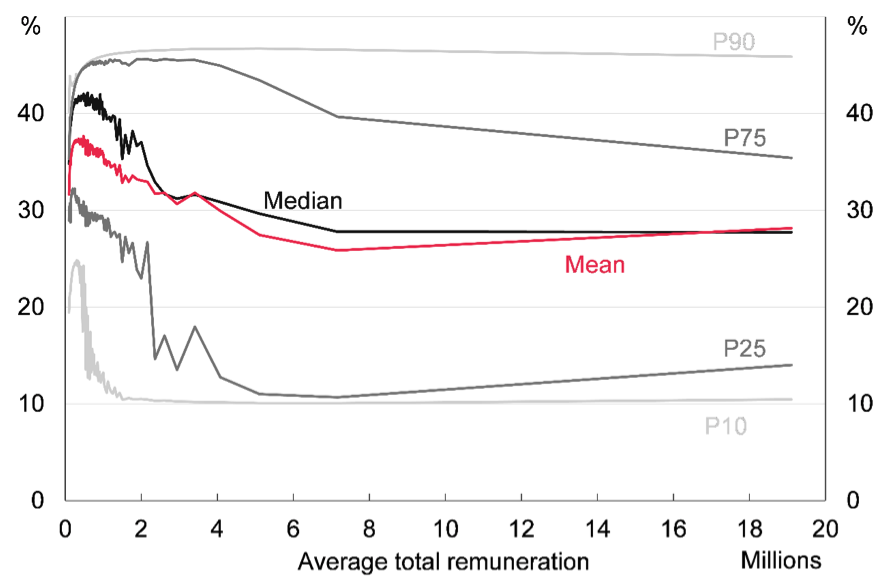

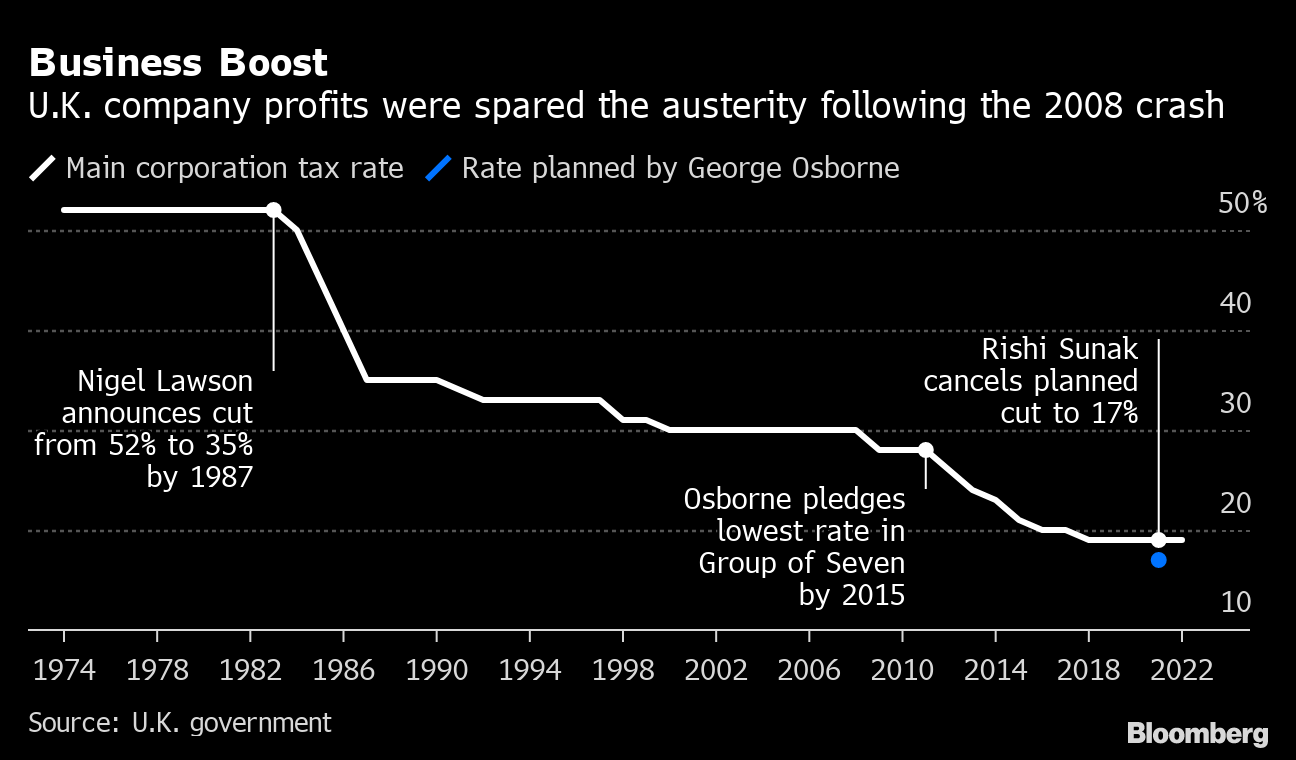

The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. At 19 the UK Corporation Tax rate is significantly.

This represents 247 per cent of all receipts and is equivalent to 7600 per household and 92 per cent of.

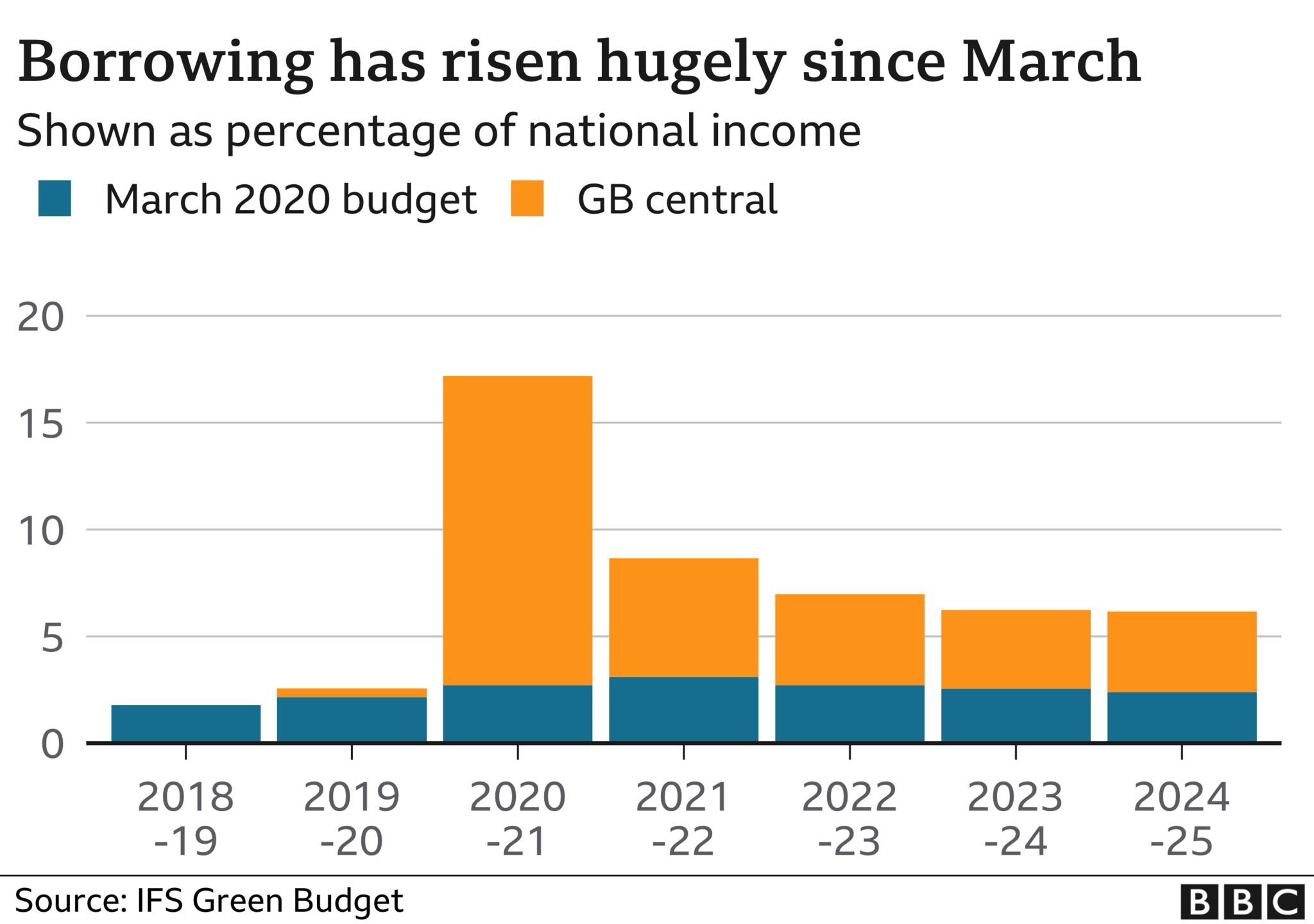

. Across these elections the average net tax rise in the 12 months following the election was 75 billion. Gains made by companies are subject to corporation tax. The UK needs to cut spending or raise taxes by 62 billion pounds to rein in its growing debt according to the IFS.

LONDON The UK. The net impact of. Higher rate Income Tax payers are projected to have an average tax rate of 220 in 2021 to 2022 a slight increase of 01 percentage points compared to 2018 to 2019.

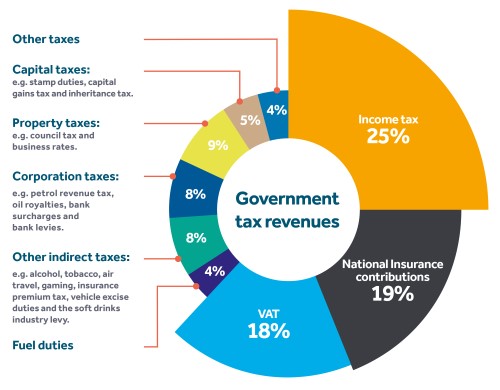

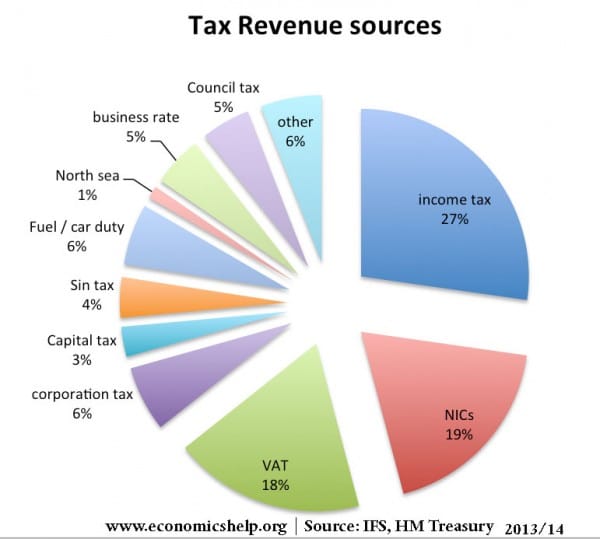

In 2021-22 we estimate that income tax will raise 2132 billion. In 202122 UK government raised over 915 billion a year in receipts income from taxes and other sources. In 1971 the top rate of income tax on earned income was cut to 75.

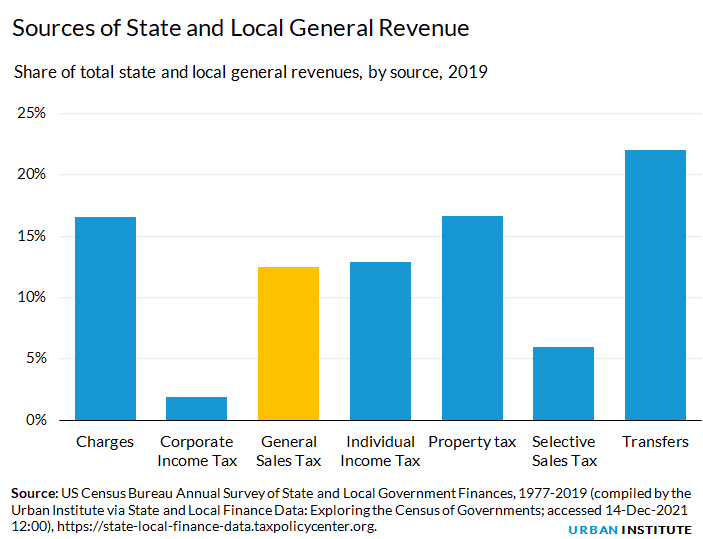

In 202021 the UK Government is expected to receive. Capital gains tax CGT is levied on profits made from the sale of assets. The UK government raises around 35 of national income in tax revenue a share.

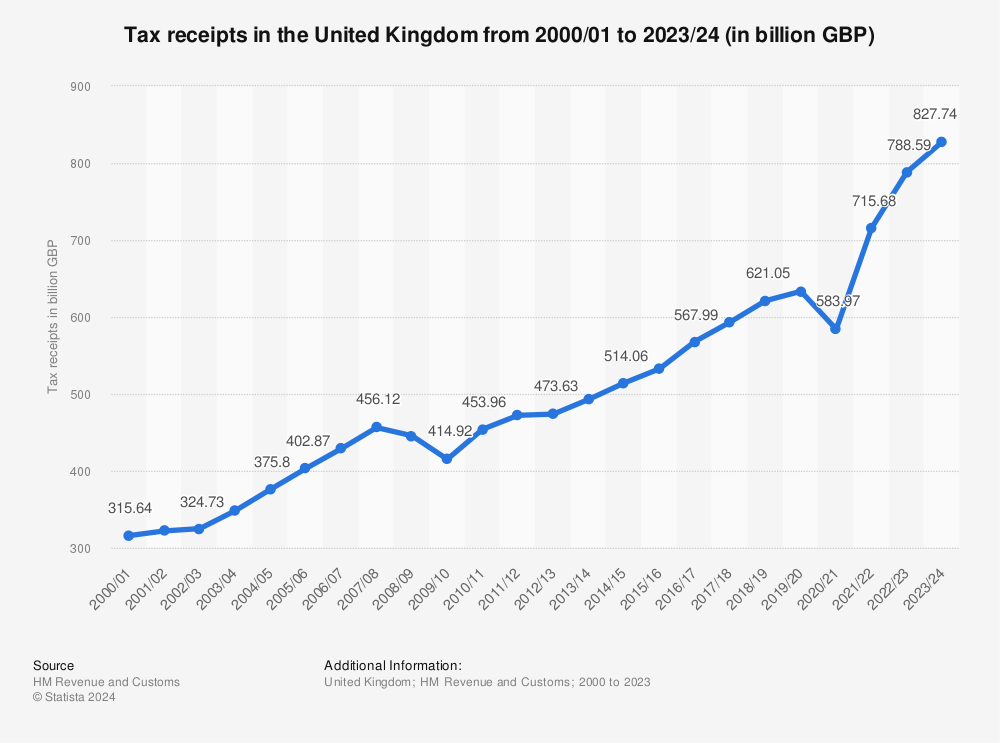

In 201920 income tax receipts in the United Kingdom amounted to 194 billion. But this doesnt mean that the. In 202122 the value of HMRC tax receipts for the United Kingdom amounted to approximately 71822 billion British pounds.

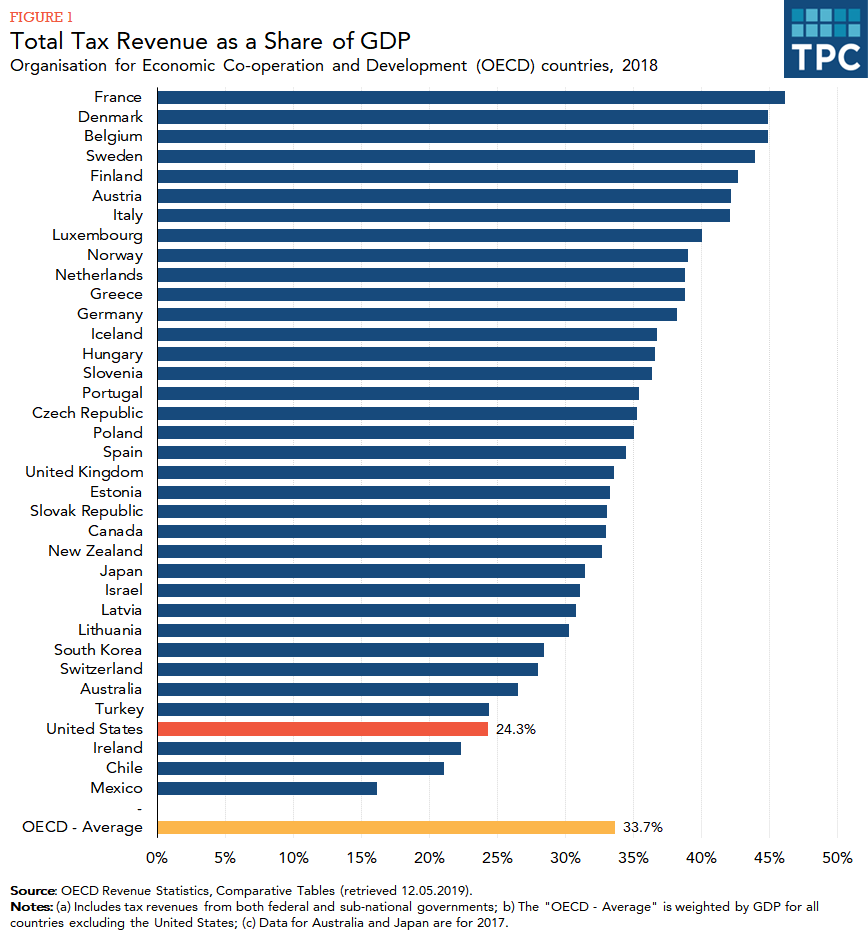

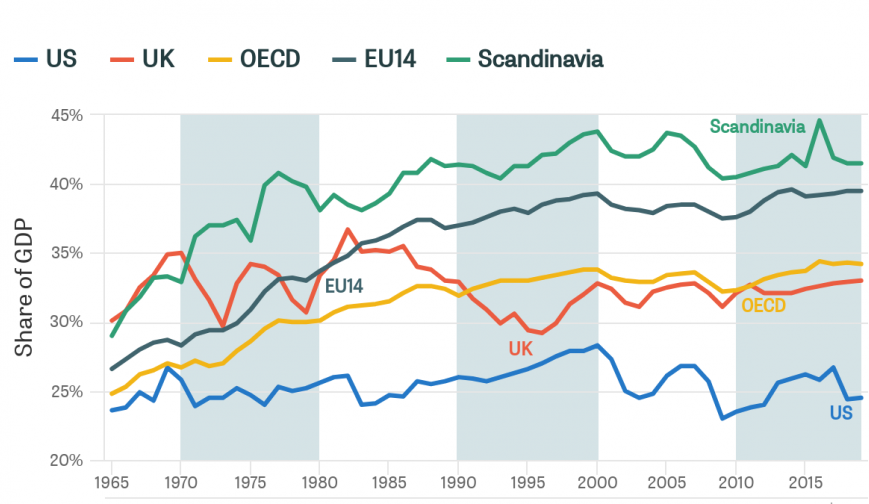

This is slightly below the average for both the OECD. UK tax revenues were equivalent to 33 of GDP in 2019. 1 The 2015 general election followed this trend.

That would be an extra 91000 in tax revenue per person. In 202122 receipts from capital gains tax in the United Kingdom amounted to approximately 149 billion British pounds an increase of approximately 37 billion pounds when. The new government had.

Tax revenues as a percentage of GDP for the UK in comparison to the OECD and the EU 15. The 45 per cent tax band was due to be scrapped in April 2023 when the 40 per cent tax rate on earnings over 50271 would have become the highest. The poorest 10 pay 4000 in tax mostly indirect VAT excise duty.

Since 200001 this total has increased by 89 billion. The increased taxes will raise almost 36 billion 496 billion over the next three years according to the government with money from the levy going directly to Britains health-. CGT is paid by individuals and trusts.

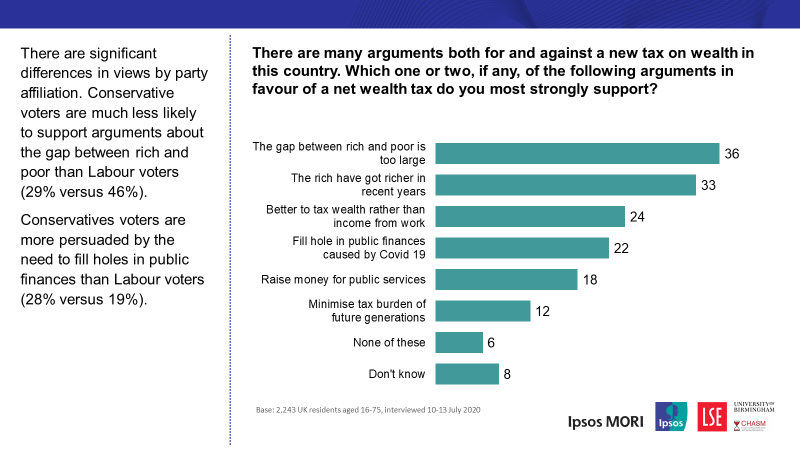

With the potential to raise 70bn a year 8 of total tax revenues taken by the government the financial benefits do add up while the criticisms of wealth taxes simply dont. The richest 10 pay over 30000 in tax mostly direct. The total amount of tax collected from additional rate taxpayers rose from 38 billion in 201213 to 46 billion in 201314a rise of 8 billion.

This represented a net increase of over 402 billion. Rather than rising to 25 from April 2023 the rate will remain at 19 for all firms regardless of the amount of profit made. Government on Monday reversed a plan to scrap the top rate of income tax after a public backlash and major market turbulence.

The UKs current tax take is high by historical UK standards but below average among OECD countries. How much does the UK raise in tax compared to other countries. But receive over 5000 in tax credits and benefits.

3 minute read September 3 2021 859 AM UTC Last Updated ago Britain set to raise taxes to pay for social care - reports. That amount is twice the size of the UKs defense budget. A surcharge of 15 on.

UK tax revenues were equivalent to 33 of GDP in 2019.

How Do Us Taxes Compare Internationally Tax Policy Center

Tax And Devolution The Institute For Government

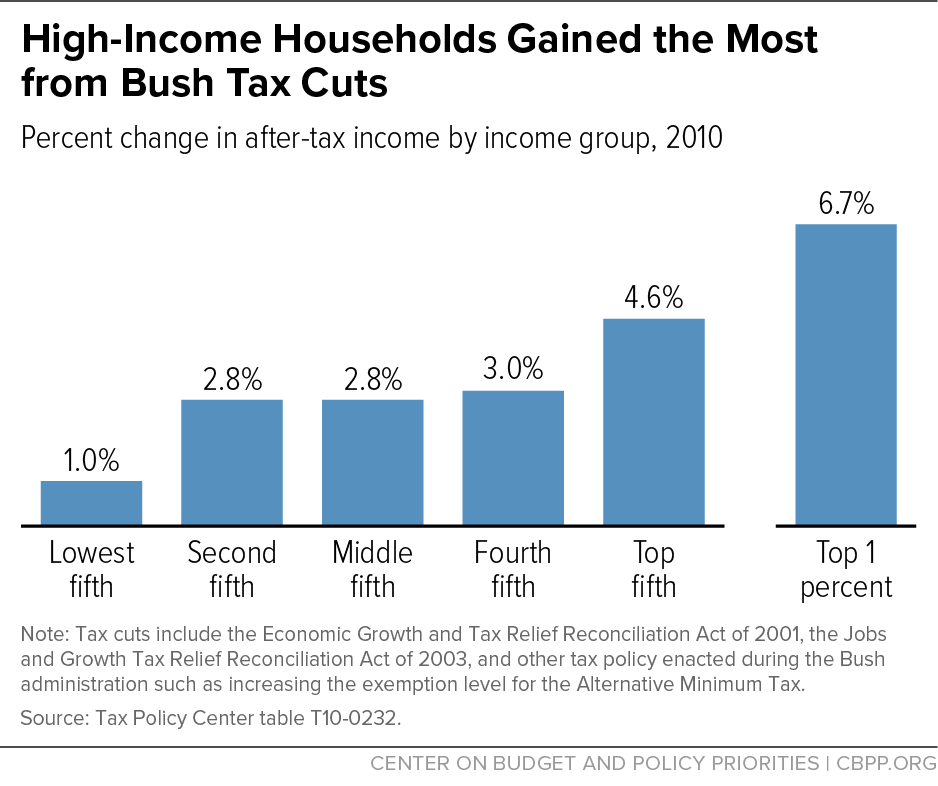

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

Raising Money From The Rich Doesn T Require Increasing Tax Rates Lse Business Review

How Do Uk Tax Revenues Compare Internationally Institute For Fiscal Studies

Taxation In The United Kingdom Wikipedia

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

Tax Statistics An Overview House Of Commons Library

Sources Of Us Tax Revenue By Tax Type Tax Foundation

Sunak S Tax Choices To Fix U K Debt Range From Wealth To Fuel Bloomberg

:max_bytes(150000):strip_icc()/dotdash-INV-final-How-the-Ideal-Tax-Rate-Is-Determined-The-Laffer-Curve-2021-01-9873ad4f5a464341aa6731540b763d76.jpg)

How The Ideal Tax Rate Is Determined The Laffer Curve

General Election 2019 How Much Tax Do British People Pay Bbc News

General Sales Taxes And Gross Receipts Taxes Urban Institute

Government Revenue Explored How Much Does The Uk Raise And Where Does It Come From By Policy Explored Medium

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

Types Of Tax In Uk Economics Help

Tax Rises Of More Than 40bn A Year All But Inevitable Bbc News